We're Here To Help You!

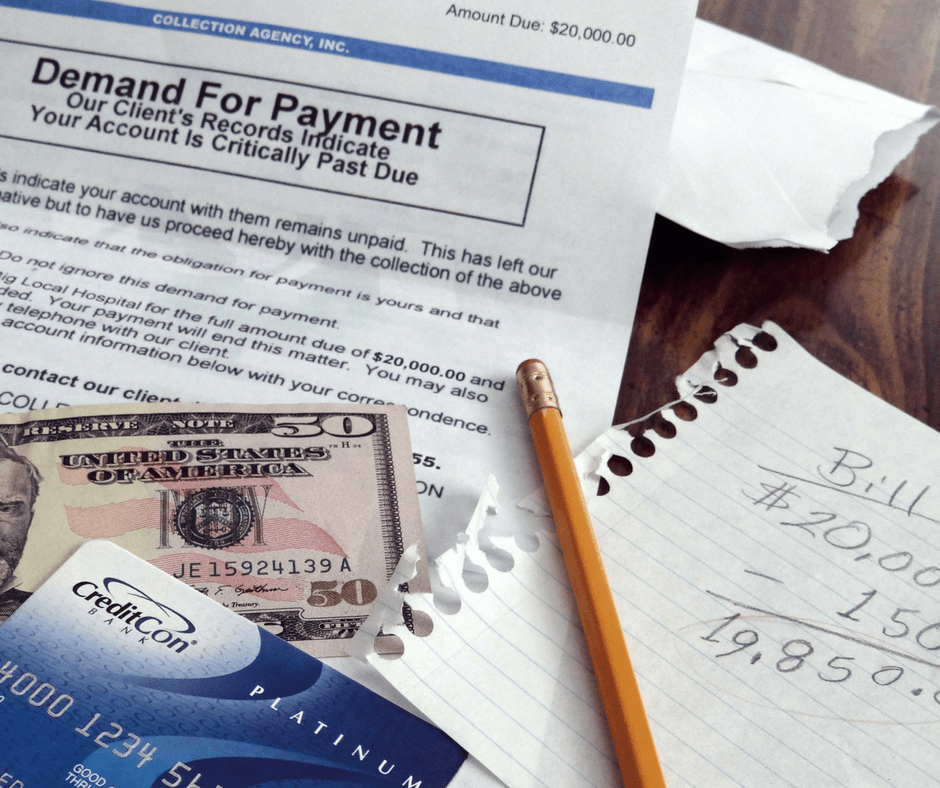

Are you looking to purchase a new home or perhaps your dream car? Do you need to refinance or lower your current interest rates? Unfortunately, your credit score could be standing in the way of you getting lower payments. That's where Credit Sense can help you. Complete the pre-qualification process and then schedule a FREE consultation!

We can help you!

Credit Sense Credit Repair will help you remove errors and inaccurate information on your credit report. You will see a boost in your score that could result in paying a lower interest rate.

CLEAN UP YOUR REPORT

AND INCREASE YOUR SCORE!

Our Mission

Credit Sense Credit Repair strives to educate consumers that lack understanding of the principles of credit. We seek to empower people to:

- Have a better understanding of credit

- Know how credit is beneficial

- Shift their thinking in regards to money

- Maintain a positive credit score

- Making credit work for them

Our mission is to educate those that were not taught, misinformed or just did not focus on their credit to become better stewards over their finances. This is done by creating healthy spending habits, saving money and investing in their future and the future generations to come.

Credit Sense Services

Credit Report Review

Credit Repair

Credit Counseling

Budget Coaching

It's All About The Numbers

Your credit score paints a picture of risk with creditors. Lenders, insurers and even employers will make judgments and decisions based on those three numbers. Car loans, mortgages and credit card rates all cost more when you have a subprime credit score. This puts additional strain on your budget.

FAQ

4 Tips To Improve Your Credit

Client Testimonials

EBONIE

North Kansas City, MO

"The information they shared allowed me to increase my credit score 50 points within a few weeks."

MALCOLM

North Kansas City, MO

CAROLYN

Clinton, MO